Summary

Increasingly more it appears as though the Federal Reserve will make some sort of move this tumble to diminish the measure of protection it is buying each month.

Maybe this truth will hit the financial exchange to an ever-increasing extent and this previous week might have been the genuine beginning to this response.

We are trusting that the Fed will assemble its story regarding why they need to diminish the measure of protections they are buying every month.

The financial exchange hit just a single new chronicled high this previous week and that was on Tuesday.

Could it be that financial backers are at long last starting to understand that the Federal Reserve must lull or even stop its acquisition of protections in the open market eventually soon?

Scratch Timiraos, in the Wall Street Journal, has even proposed that the tightening may begin by the center of November this year. Furthermore, 2022 would be a year that the market confronted a Federal Reserve that may even support increasing loan costs.

The issue is that the entire approach circumstance will take on increasingly more the tone of the world of politics.

The Biden organization is pushing two spending programs in congress. In the first place, the framework bill, with a sticker price of about $1.2 trillion, and second, the social help bill, with a sticker price of about $3.5 billion.

These two drives address the essential purpose of the Biden organization to the extent financial projects go and the mark it might want to leave for what’s to come.

I have a few issues with these projects, gives that I have examined somewhere else.

However, with these projects going along, the organization would not like to confront a Federal Reserve that is easing off from its accommodative program, one that is providing monstrous measures of stores into the financial framework.

On the off chance that the Biden bills go through and the Federal Reserve starts to tighten its buys and starts to permit financing costs to begin to climb in 2022, we have a genuine political issue.

How could Biden permit the Fed to tighten its buys and permit higher loan fees despite such a lot of expenditure and all the obligations that the planned projects will create?

This is a political issue and financial backers must understand that this situation will be a piece of the truth of things to come.

Last Week

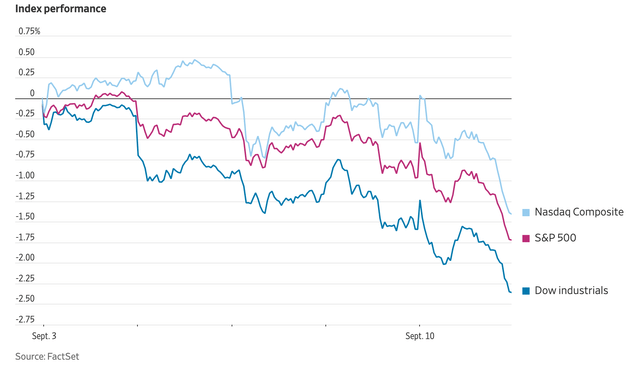

Last week, the securities exchange shut down. The Dow Jones Industrial Average was off 762 focuses; the S&P 500 stock record was down 76 focuses, and the NASDAQ composite file fell by 249.

There was not actually a ton of development on the lookout. A few investigators guaranteed that the market showed more unpredictability this previous week than it had the entire summer when the market was persistently hitting all the more new noteworthy highs.

The main thing that appeared to create any premium in the securities exchange was the spread of the Delta variation and the impacts this spread may have on financial execution this fall.

Other than that, the essential vulnerability hitting financial backers was the worry over what the Federal Reserve will do.

Central bank Will Dominate The Scene

There are not many that presently differ that the Federal Reserve must take care of the measure of protection it is buying each month.

Jerome Powell, the Fed’s seat, has constantly expressed that what the Fed wills rely on the insights. That is, the Fed will keep on buying $120.0 billion in protection from the market each month until the information verifies that the Fed needs to lessen the measure of buys that it is making.

All in all, the Fed needs a proper story to legitimize its adjustment of strategy position.

Also, this is the place where things get tricky.

Financial backers have been depending on the Federal Reserve for over eleven years presently to endorse the rising business sector.

The Federal Reserve has been extremely liberal in satisfying financial backers’ hopes and in developing financial backer trust.

Presently, the Fed is confronted with breaking this trust by being significantly less liberal to the market, even to the reason behind removing holds from the market.

The Fed realizes that there will be a revision to the market if and when they take such an action, a transition to turn out to be less liberal.

This is the reason the Federal Reserve needs an account. The Fed needs the right account to keep the trust of the speculation local area and to direct any descending change that the market may make.

So the Fed must have an excellent story. It should be acceptable. It should be satisfactory. Also, it should be executable.

The Federal Reserve is truly on the spot here, and, I accept that Mr. Powell truly realizes how much pressing factor is on him and the Fed to recount a decent story and pull off the adjustment of strategy.

A Piece Of History

The image of securities exchange execution over the previous decade is breathtaking.

In any event, considering the drop-off during the short downturn in 2020, the ascent in the financial exchange for this full-time span is amazing. Other than the 2020 slump, the financial exchange has risen ceaselessly.

This presentation, as I have contended, can be essentially seen as the aftereffect of the Federal Reserve activities. This is the reason the ascent in the market has all the earmarks of being so standard and consistent. This is the thing that the venture local area has come to trust.

Presently, we are confronted with another situation.

The Fed would not like to annihilate all the trust that it has developed.

It should have a decent story. The account should be sound.

Furthermore, thus, it appears, this is the thing that we are sitting tight for.

Financial backers should be ready for this move and they should deliver some system to manage an adjusted Federal Reserve strategy climate. This change isn’t something that the financial backer can treat gently and simply survive. Financial backers need to think and plan for what they need to accomplish during a period that the Federal Reserve isn’t so liberal.

The principal objective of this new system should be well-being. The change could be very sharp and keep going for a lengthy period. What will ensure capital in this change period? Other than security of head, the proper pay region guarantees minimal nowadays. However, perhaps for the period, one requirement to plan ahead and adjust one’s portfolio to where the economy is by all accounts going and where the new innovation is taking us.

Last Week’s Performance

The exhibition of the securities exchange this previous week might address a sign of where we are in the story, as the Fed attempts to characterize the account it will need to introduce the venture local area when it eases off its present approach position.

Along these lines, we should live with this vulnerability until Mr. Powell and the Fed feel that they are prepared.

Try not to be shocked, notwithstanding, if the occasions of things to come will be loaded up with endeavors by the “political” to express their opinion in how money-related strategy is to advance.