Summary

In this article, I will detail the channel through which the US financial approach influences Hong Kong land – that is the USD/HKD cash board kept up with by the HKMA.

The outlandish trilemma in financial matters is keeping a decent swapping scale, zero capital controls, and a free money-related strategy.

National banks that have cash sheets are sticking their swapping scale worth to the USD inside a specific reach.

The HKMA stakes the HKD to the USD at a scope of 7.75-7.85. To do this, they in actuality need to import the yields and money-related arrangements of the United States.

In the event that security yields ascend in the United States, they should likewise in Hong Kong to protect the cash board range, prone to the disservice of the more vulnerable HK economy and high as can be land costs.

I will begin with the Federal Reserve’s approach tie they are in and will follow with how this influences Hong Kong’s housing market. I accept the Fed is in a situation, in the sense the national bank of the United States can’t keep US Treasury yields down regardless of whether they needed to. More QE or not, tighten or no-tighten.

I’ve been upholding for a shape and still feel it is the reasonable result, as it is the thing that the Fed has conveyed, however even in a no-tighten situation US yields would ascend on the swelling assumption part. US expansion information has shown to be more responsive and dynamic than recently expected which has driven the Federal Reserve into a tight spot.

We saw this keep going Friday on the frail positions report. Tightening plan assumptions were pushed back, yet UST yields actually rose. This is on the grounds that the less or later possibility of a shape, the higher US inflationary powers will go. Inflationary assumptions are a part of security yields.

At the point when the Fed chooses to pull back on convenience, US Treasury bond issuance will overpower request as the Fed has been a central part in engrossing that issuance. Security costs move conversely with yields, so when US security supply (US government issuance) dominates request, security costs fall and yields thusly rise. As one can deduce from the over two sections, the Fed is in an impasse to keep US yields down.

There are worldwide overflow impacts of rising UST yields particularly on developing business sector economies and the people who have USD money sheets. This carries me to Hong Kong. National banks who oversee economies with cash sheets like Hong Kong, must “import” US security yields or rates to keep the conversion scale not set in the stone territory. This is a result of conveying exchanges and streams of cash because of relative financing costs or differentials.

Convey exchanges are one of the main powers in unfamiliar trade markets. A model is getting yen at around 0% yield and putting resources into Russian securities yielding around 7%, catching the distinction and furthermore remaining to acquire on any appreciation in the RUB against the yen. It tends to be a productive procedure particularly when utilizing influence, yet convey exchanges breakdown when the subsidizing money (lower-yielding) appreciates against the resource cash (higher-yielding). This FX enthusiasm for subsidizing cash against the resource money clears out gains on the loan fee differential. This is regularly at first catalyzed by the security yield differential narrowing or modifying.

The national bank of Hong Kong, or HKMA (Hong Kong Monetary Authority) consequently can’t allow the US to security less Hong Kong security yield differential extend excessively or it spikes do exchange streams of Hong Kong dollars into US dollars. The HKMA should follow US yields higher or hazard the cash board imploding which has existed for more than 35 years.

The HKMA effectively mediates in their interbank and FX markets to keep up with the money territory against the USD. For instance – when US yields rise and the USD appreciates, the HKMA sells USD from their unfamiliar trade holds and purchases HKD. This lessening in the supply of HKD from their interbank market pushes up Hong Kong interbank rates and security yields – along these lines safeguarding the stake.

There is a real framework wherein the money board is overseen, yet it has gone under pressure before in the 1997 Asian Financial Crisis. At the point when US yields rise, Hong Kong’s must too in short. The inquiry is what are the implications of higher Hong Kong yields on their economy – like GDP development, work, and their housing market?

While Hong Kong’s GDP on a year-over-year premise has risen 8% in Q1 2021 and 7.6% in Q2 2021, the latest perusing enlisted a – 0.9% quarterly compression. This signs debilitating force and prohibits unusually low 2020 pandemic base impacts. Hong Kong was battling and in downturn pre-pandemic which makes the obstacle to getting back to solid development considerably more troublesome. The following are outlines of ostensible Hong Kong and US GDP graciousness of Economy.com. The last is plainly on a superior course.

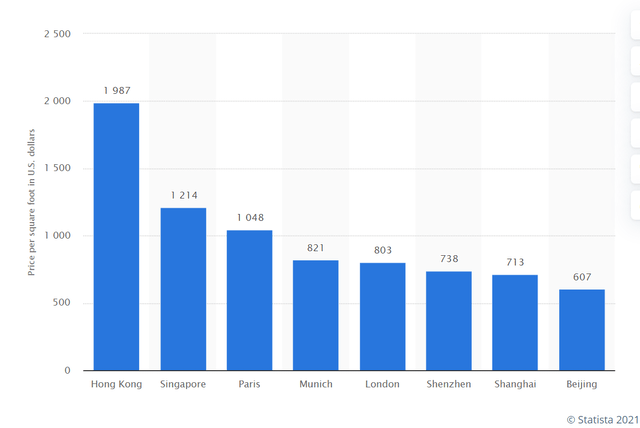

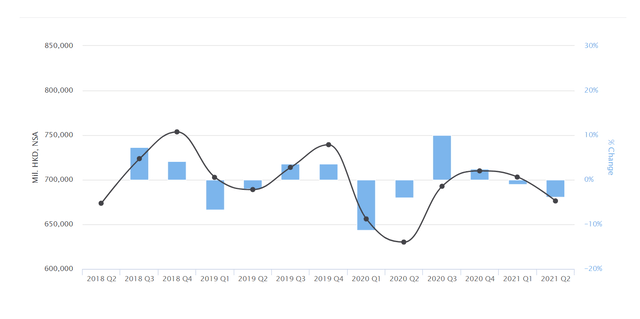

Hong Kong property costs are, so, crazy. Hong Kong has by a wide margin the most elevated per square foot costs on the planet at $1,987/square ft. With the public safety law and expanded Chinese Communist Party impact in the area, we have seen and would keep on anticipating a mass migration of Hong Kong inhabitants. That is irrelevant, however. The truth of the matter is homes are plainly being utilized as speculative resources or products to be exchanged, not to live in. It is extremely suggestive of 2008 in the United States.