Individual budget specialists have long held that homeownership is a critical stage in creating enduring financial momentum. A house is a resource that by and large values in esteem after some time, and purchasers likewise benefit from influence: You can get up to 80% of the worth of a home, or significantly more with a wretched installment credit.

Before people approached minimal expense common assets and money market funds, the stock and security markets were restricted to institutional and profound stashed financial backers. For every other person, purchasing a house was the essential method for effective money management, says teacher Ken Johnson, of Florida Atlantic University, who has practical experience in rental lodging and housing statistical surveying. Johnson is likewise the co-maker of the Beracha, Hardin, and Johnson Buy versus Lease Index. The list investigates 23 U.S. metropolitan regions to decide if economic situations favor leasing or purchasing with regards to abundance amassing.

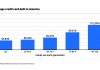

In a new update, the file presumes that in 17 of the 23 metropolitan regions, including Atlanta, Los Angeles, and, shockingly, Detroit, shoppers would be in an ideal situation leasing and putting away the cash they would have utilized for an up front installment, shutting costs and other lodging costs — despite the fact that rents have soared. The middle home deal cost in the U.S. hit about $429,000 in late April, and 30-year fixed contract rates as of late increased to 5.27%, the most elevated since the late spring of 2009. Throughout the course of recent long periods of positively trending market returns, the S&P 500 record has expanded 11.7% on an annualized premise, contrasted and a 7.9% yearly ascent in home estimations.

The most effective method to Rent Strategically

For leasing to convey a better yield, you really want to have sufficient cash left after you pay your month-to-month lease to contribute. Furthermore, that boils down to individual decisions.

For instance, assuming that you would be content with a one-room unit, pick that over the pricier two-room unit, or skirt the complex with the pool.

Or on the other hand, assuming that you’re like me and live in a costly metro region, you might decide to set aside cash by living beyond the city. Indeed, even with my lease expanding by $50 a month in August, it’s as yet less expensive than rates for nearer lofts in the Washington, D.C., region. I have likewise done without certain conveniences, like a pool, in-unit washer and dryer, and modern machines. It is not necessarily the case that I am not happy in my condo — I can engage gatherings of companions, and there’s a lot of daylight for my plants — yet the absence of these conveniences keeps my costs within a reach I’m OK with.

Notwithstanding these kinds of compromises, tenants need to start saving. Pay yourself first with programmed moves from your checking to your investment funds or money market fund. On the off chance that you approach a 401(k) or another manager-supported retirement plan, contribute however much you can.