A FICO rating is a number that outsiders, particularly banks, use to evaluate the danger of loaning you cash. The score is one-way banks, Mastercard organizations, and different establishments survey the probability that you can or will actually want to take care of any obligations you amass. A higher FICO assessment shows that your present monetary conditions and your verifiable conduct exhibit a readiness and capacity to take care of any advances you might be endorsed for.

In the United States, the credit scoring framework you will find out about most is the FICO score, a score utilized by significant credit offices to rate your reliability. Your FICO score will be somewhere in the range of 300 and 850 with a higher score being better. With regards amazingly, loan specialists may now and again allude to it as far as Credit Level or Credit Quality, for example, Poor, Fair/Average, Good or Excellent with every class alluding to a scope of FICO scores.

Helpless acknowledge is viewed as anybody for a FICO score under 580

Reasonable or Fair FICO assessment will be somewhere in the range of 580 and 669

Great credit is somewhere in the range of 670 and 739

Generally, excellent credit is somewhere in the range of 740 and 799

Great credit is anything over 800

What Your Credit Score Means for Some Financial Products

Your FICO assessment can have an impact twoly: Whether you can get endorsed for a monetary item in any case, and what loan costs you might need to pay in case you are supported. The higher your FICO score the almost certain you are to get supported for a Mastercard or advance, and will generally decrease the financing cost related to that specific credit or card. Lower scores might preclude you for an item or administration totally and can raise your loan fees essentially something else.

For some, Mastercards, particularly the most worthwhile prizes cards, the cards are offered distinctly to customers that meet a base credit quality. A large number of the best cards are solely showcased to purchasers with astounding financial assessments. With regards to charge cards, your financial assessment can decide the broadness of alternatives you can browse. Most cards are likewise showcased with a scope of loan costs/APRs. The genuine loan fee on your particular card will be contrarily identified with your FICO assessment with higher financial soundness getting lower financing costs as well as the other way around.

With home loans and vehicle credits, banks act also. Your financial assessment is utilized as a part of whether a bank will decide to support an advance or may constrain you to make extra concessions for endorsement. It can and by and large will move the financing cost you pay on the credit too.

The Components Of Your Credit Score

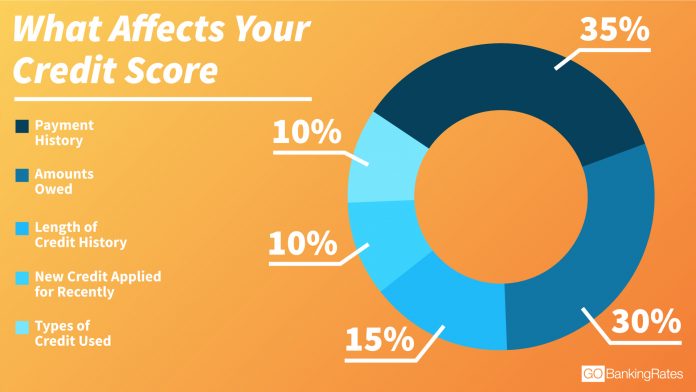

The cosmetics of your FICO score is separated into a lot of central points: Payment History (35%), Debt Burden (30%), Length of History (15%), Types of Credit(10%), and Recent Credit Searches(10%). How about we investigate how these parts fit into making your general credit profile.

Installment History

Your installment history is overall the biggest single part of your FICO score. The most ideal approach to think about your installment history is to think of it as a history of the multitude of things you’ve fouled up with regards to credit and a proportion of how you act with regard to your obligations. You don’t get a lift for paying things on schedule however much you get punished for not doing as such. A set of experiences set apart with antagonistic data would show that the individual regularly faces trouble meeting their obligation commitments, or rather somebody that has an unsafe disposition with regards surprisingly. Both are signs to the moneylender that they might need to be warier with regards to making extra credit accessible.

Late Payments

The most well-known issue shoppers face in the installment history part is late installments. Regardless of whether it was on the grounds that you essentially neglected or were battling to earn a living wage, being late on a regularly scheduled installment for your Visa or an advance will for the most part cause a negative change on your FICO rating. The amount of an effect can likewise rely upon how late you were with the FICO score making bigger descending changes the later it is. You will see this considered your acknowledge report for late installments set apart under classifications like 30-days or 60-days and so on One thing to know about is missed or late installments on what might seem like minor sums can be similarly as harming.

One significant justification behind keeping the number of Visas and records you have at a reasonable level is to stay away from these issues. It’s too simple to even consider opening up a store Mastercard, make a charge on it and basically disregard the record. Regardless of whether you’re making a huge number of capable installments on the entirety of your different records, neglecting to pay off the $50 you spent on that oddball charge can drastically hurt your FICO assessment.

Obligation Burden or Accounts Owed

The other significant part classification of your FICO assessment is the separation of your current obligation trouble including the amount you owe altogether, what kinds of advances you have, and some other quantitative markers about your general obligation/credit profile. As a pointer of your financial soundness, the amount you owe and how it’s split up across the various kinds of credits goes about as a sign with regards to your ability to deal with your current obligation.

With regards to how this plays into your FICO assessment, it’s presumably not advantageous to consider it was higher/lower = better. No doubt, the FICO estimation doesn’t assess your obligation trouble in detachment however considers it corresponding to things like your installment history. For example, we should consider a credit profile of somebody who has a lot of obligations however a long and flawless installment history. This may show that the individual is monetarily wealthy and the obligation trouble is a sign that any extra credits may be commitments they can undoubtedly deal with.

Take a similar degree of obligation on a profile with a new history of installment issues, and the higher quantitative components ought to be a significant warning. This shopper might be experiencing issues getting by and surprisingly a limited quantity of extra credit may be a hazardous recommendation.

Credit Utilization

Credit Utilization or Debt to Limit proportion is regularly raised while examining the Debt Burden part. It is one of the pieces that make up this piece of your FICO score and is a proportion of the aggregate sum of obligation on your charge card accounts against as far as possible permitted on those records. A lower credit use, which means your normal equilibrium is lower compared with the aggregate sum you could have on your cards is better for your score.

This proportion can become possibly the most important factor when you may somehow or another consider dropping a current charge card. Regardless of whether you don’t utilize that card, as long as it doesn’t have any charges related to having it around, your credit use figures look better in view of the bigger complete credit limit in general. This additionally implies that mentioning a higher credit limit on existing Visas can help your FICO assessment since it will assist with bringing down the general proportion.

I presume that the explanation for this action is utilized as a factor is that it’s a useful pointer of how much space for error you have with regards to your accounts. In case you’re just utilizing a little piece of what the card organizations have passed judgment on you to be equipped for paying off, then, at that point, little changes in your individual budgets or gradual obligation may not put you in considerably more danger.

Length of Credit History

Your score represents the time allotment the different records under your name have been near, including the normal sum across every one of the records just as the length of your most established open record. The length of your set of experiences assists with showing how to delegate different elements of the score are about your reliability. The more seasoned your records and your general record of loan repayment, the bigger the time period from which an organization can precisely judge both your accounts and conduct towards credit. A couple of long stretches of information about purchasers is a superior marker for how they might act in the future than having a couple of long periods of data.

Thinking about Age of Account When Canceling Cards

The record length can become possibly the most important factor while taking into account how you should manage something like an old Visa. As a rule, the principal Mastercard a purchaser gets may presently don’t be the most ideal alternative going ahead. This is regularly the situation for somebody that might have had no financial record to discuss while getting a card and have over the long haul constructed an extraordinary record for themselves.

Kinds of Credit

The littlest part of your financial assessment, your FICO score considers the various sorts of obligation or credit utilized. Your records are ordered into things like rotating credit (Visas), contracts, customer funds, or portion advances and a background marked by having a more extensive openness might be a positive sign. For what reason ought have a set of experiences with more credit types matter? Having a current history of openness to various kinds of credit is a useful marker that a buyer knows about the diverse monetary items and can oversee them fittingly. Purchasers likewise might not have a similar disposition towards taking care of a Visa versus their home loan so a moneylender should be more mindful of somebody with a smaller openness history.

Similar to the Length of history part, the kinds of credit part is logically utilized as an action for how agent your current record test size will be about your future conduct. An extensive delegate history will as a rule be a superior indicator of how a purchaser will act in the huge scope of credit circumstances later on.

Late Credit Searches

The last part of the FICO score is a change dependent on any new ventures or hard requests made into your credit profile. This tracks the occasions banks have mentioned your information, with the potential for a steady big number of solicitations to drag your score down.

The FICO score computation makes various changes by the way it assesses the number of requests notwithstanding. With regards to contracts, automobile credits, and understudy loans it’s normal that most shoppers will look for rates at an enormous number of banks so all pursuits of these kinds that happen within 14 to 45 days of each other are viewed as a solitary solicitation. These requests additionally require 30 days before they influence your score so you will be assessed decently while rate shopping. These changes imply that shoppers looking for an advance are best served if they pack the time where they rate shop, to such an extent that they affect their score in general.

Ultimately, purchasers regularly undergo FICO rating inquiries for reasons other than getting an advance. This might incorporate checking your own financial assessment or a necessity as a component of the business. In these cases, the questions are not viewed as a hard draw/request and won’t show up on the reports utilized by the banks for assessment.

Why You Have Three Different Credit Scores

Given the above parts for your FICO assessment, for what reason do customers have three distinct scores? This is on the grounds that there are three diverse credit agencies that autonomously compute your score: Experian, Equifax, and Transunion. While the three organizations utilize fundamentally the same cycles for deciding your FICO rating, there are few contrasts by the way they’re finished. Another inconvenience is that the three agencies may not all have similar data on you in their frameworks when making these judgments. This regularly happens when a record in your record of loan repayment has been accounted for to one authority however not another.