What is an Alternative Investment?

What is elective speculation? Elective speculation is anything you can’t accept in a standard 401(k). Stocks, bonds, and money are not elective speculations.

For a great many people, their greatest “elective venture” island. You can claim land in a 401(k) through REITs and shared assets, however, you can’t possess the deed to a property. You need to set up an uncommon construction assuming you need to put your retirement reserve funds in the property. You additionally can’t claim gold bullion, craftsmanship, or different collectibles.

A few sorts of elective speculations will expect you to be an authorized financial backer. To qualify as one, you should have the option to fulfill a couple of conditions like total assets and pay. Some venture stages should affirm you as an authorized financial backer while others will trust you.

Do you Need Alternative Investments?

The way to contributing is enhancement.

You would prefer not to be overexposed in any one region.

It’s the reason specialists suggest you get a proper blend of stocks and bonds. It’s likewise why you need a decent blend of homegrown and global, so the burdens of any one country don’t sink your fortunes. It’s likewise why specialists prescribe some piece of your portfolio to be in elective ventures.

In principle, choices should be firmly related to the financial exchange or numerous outside powers. They might be adversely related, as frequently is the situation with gold and the financial exchange.

The amount Should be in Alternative Investments?

This is a difficult inquiry since elective speculations are so unique. They are not ideal substitutes for each other.

Different ventures might be a superior term! The land is nothing similar to craftsmanship. Craftsmanship is nothing similar to mineral rights.

All things considered, specialists will say that you ought to be somewhere in the range of 7-12% in elective resources. The land is elective speculation. For some, home value is a tremendous level of their total assets… such countless individuals as of now have gigantic openness to land and do not know it.

What are the Best (and Fun) Alternative Investments?

Presently to the pleasant stuff!

I will introduce a rundown of fun elective ventures.

A portion of these are somewhat odd… however that is essential for the good times. Keep in mind, this isn’t an underwriting of any of them!

Farmland

I examine general land in the following segment however farmland is a unique subclass that merits uncommon notice. It’s been generally undeniably challenging to put resources into farmland, particularly farmland in light of the fact that there haven’t been numerous stages that allure for that market.

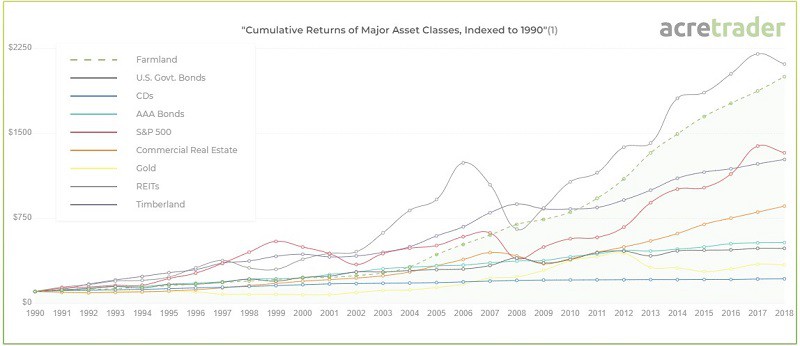

Farmland has had an awesome run since 1990 and $10,000 put resources into farmland in 1990 would be valued at $199,700 today. The S&P 500 developed with regards to 13X over that equivalent period (counting profits).

There’s one new organization that is wanting to change that – they are named AcreTrader.

Farmland Appreciation from 1990 to 2018

Been most intriguing that farmland returns are moderately steady over that period. While the financial exchange can bounce up and crash pretty savagely, farmland is a sluggish ascension vertical as a resource class. It’s exhausting however I truly like exhausting as long as it goes up.

With AcreTrader, they research the farmland, select under 5% of them, and make a lawful substance into which you can put away your cash. At the point when you contribute, you become a proprietor of that homestead and this is totally done 100% electronically. AcreTrader pays out overabundance pay (3-5% for okay properties) and charges a level 0.75% expense of the homestead’s worth, typically deducted from the pay. Their objective unlevered inner pace of return is 7-9%.

You can peruse a more definite glance at Acretrader in our survey.

It’s captivating and you can get a free record to perceive what they offer at AcreTrader.

Craftsmanship

I recall when I heard the narrative of Steve Wynn (of the club domain acclaim) put his elbow into Picasso’s painting named ‘Le Rêve.” He had intended to offer it to a flexible investments chief for $139 million of every 2006 except the arrangement fell through after Wynn put a silver dollar-sized opening in the canvas! Everything worked out in light of the fact that a speculative stock investments chief got it a couple of years after the fact for $155 million. Elbow openings or not, compelling artwork appreciates.

Assuming you need a piece of compelling artwork, one of a handful of the approaches to put resources into this resource class is with an organization called Masterworks. Similar to crowdfunded land, Masterworks allows you to purchase little proprietorship stakes in bits of workmanship.

How it functions is they purchase “blue-chip craftsmanship” and afterward sell shares at $20 an offer. At the point when they buy a work of art, they’ll likewise document a contribution roundabout with the SEC so you’re ensured by protections laws. They charge a 1.5% administration expense in addition to 20% of any future benefits. They hope to leave each holding following 7 years and at most 10 years.

We suggest perusing our total survey of Masterworks if this speculation intrigues you.

It’s allowed to pursue a record and look at what Masterworks offers.

Wine

In 2019, we put in half a month in the Tuscany district of Italy. We went to a few wineries and were astonished at how great the wine was and how cheap it was. The vintners disclosed to us that by far most of the Italian wines are devoured inside the nation – very little of it is sent out abroad.

As we visited different grape plantations and learned a greater amount of the set of experiences, it ended up being undeniable why wine authorities exist. Every year, a set number of containers are delivered and when the winery is well known, or the vintage is superb, the worth of each jug increments. Over the long haul, less and less of these containers exist since individuals drink them, they break, whatever.

Craftsmanship is, hypothetically, perpetually in light of the fact that you don’t burn through it to appreciate it… however wine isn’t.

There’s an organization, Vinovest, that hopes to acquire contributing wine to the majority. Through the stage, you can purchase bottles, have them sent to their storage spaces, and really “contribute” to wine without every one of the issues and troubles of putting away the jugs yourself (which is costly to do without anyone else). These aren’t thousand dollars for every jug wine – they’re speculation grade however not costly. As a rule, we’re looking at purchasing 10 jugs valued at $100 versus 1 jug at $1,000.

What’s more, assuming you need your jugs, you can request them, and Vinovest ships them to you. It’s an interesting model.

Here is our Vinovest survey for more point-by-point data.

There is a $1,000 at least and you can discover more at Vinovest. co.

Land

The land is the most well-known elective venture (farmland is actually a subcategory of land, however, it’s a really fascinating one).

Claiming a house is important for the American Dream. Your house is the place where you reside yet additionally speculation. On the off chance that you sell your home for an addition, you owe burdens on it (after the home increase rejection).

As the maxim goes, they aren’t making any more land. Thus, numerous financial backers consider land when contemplating how to extend their portfolios.

On the off chance that you would prefer not to purchase property, either to hold or to flip, there are alternate approaches to engage in this resource class. You can put resources into the property through a crowdfunded land site.

Or on the other hand, you can turn into a hard cash moneylender to another financial backer. This is the point at which you credit somebody cash and the property is security for the note.

Entombment Plots? Indeed.

Another offbeat “land” resource is to purchase and sell internment plots. That’s right. Those square shapes of land in a burial ground.

On the off chance that you can move beyond how horrible this sounds, it’s the same as some other sort of land – it’s simply more modest packages. There isn’t a Redfin for internment plots, so the information gathering is a bit harder, yet you can purchase and sell entombment plots like some other piece of property. Probably the best spot to look turns out to be Craigslist.

Here is a glance at what was accessible close to Baltimore, Maryland:

Costs will change dependent on the space. They run anyplace from a couple of hundred bucks for a plot to two or three thousand, in view of the area. At the point when you purchase or sell, it’s planned with the burial ground’s delegate.

Gracious, and here’s a smidgen of bleak humor. At times a posting will say that the plot is “utilized” or “used.” Yikes.

That is typically a mistake with respect to the vendor. A graveyard will not cover somebody in a plot that is now being utilized.

I don’t know what the profits are on this sort of speculation however it’s captivating that it’s even a chance.

Valuable Metals

After genuine property, valuable metals are the following most normal elective speculations. They’re regularly seen as a store of significant worth, which is like having a little protection strategy.

You can put resources into valuable metals through ETFs and common assets or purchasing bullion. In case you’re expecting to utilize it as a store of significant worth, bullion is the best approach. On the off chance that you would prefer not to store it yourself, you can purchase bullion through assistance like Vaulted, which stores it in the Royal Canadian Mint. (full audit of Vaulted)

On the off chance that you just need it as a fence venture, you can put resources into ETFs or you can put resources into mining organizations.

Assuming you need bullion, you can purchase that near the expense of the valuable metal from a vendor on the web. Or on the other hand, there is a class of valuable metals known as “garbage silver,” which alludes to the silver substance of normal coins. The worth is in the silver substance and it is generally expected not unadulterated silver. These are frequently more established coins, think pre-1960’s, when coins had more silver.

Around my work area, I have a silver quarter, made in 1957, that is worth around five bucks. It’s a collectible, esteemed for its materials, and I thought that it is in a field. It stood apart to me since it was a quarter in a field however it looked truly dull. The bluntness was a result of the metal creation, 90% silver, and presently it’s my little introduction to numismatics (and a suggestion to be perceptive!).

I’m awful at it. In case I was from the beginning Facebook, Uber, Airbnb, or some other unicorn-I