Charge card expenses and loan fees decide your actual expense of acquiring. In the previous decade, administrative and market changes have affected those expenses.

The Credit CARD Act of 2009 put down certain boundaries on rate increments and expenses that could be charged to credit cardholders. The card business changed because of the law: Instead of offering low rates forthright with large back-end rate climbs, it turned out to be more straightforward and set more genuine forthright rates. That has brought about somewhat higher introductory rates for customers, however, less astonishment corrective charges and rate climbs.

As indicated by the Federal Reserve Board’s Report on the Economic Well-Being of U.S. Families in 2020, 83% of U.S. grown-ups have no less than one Visa, about a portion of whom conveyed an equilibrium once over the past year. The individuals who conveyed an equilibrium paid interest at some point.

The uplifting news for cardholders is that financing costs have not expanded back to pre-pandemic levels. Notwithstanding, a 2020 charge review by CreditCards.com tracked down that the normal Mastercard has 4.48 expenses related to it, with late expenses and loan expenses being the most widely recognized.

Normal expenses brought about via cardholders

Late installment expense

Government guideline draws certain lines on Visa late charges. A 2020 Consumer Financial Protection Bureau (CFPB) report noticed that the greatest late expense that can be charged on first misconduct is $29 and $40 for ensuing wrongdoings. These sums can be changed yearly for expansion, and these greatest late charges for 2019 were $28 for first wrongdoing and $39 for resulting misconducts. The most extreme late expenses for 2018 were $27 and $38.

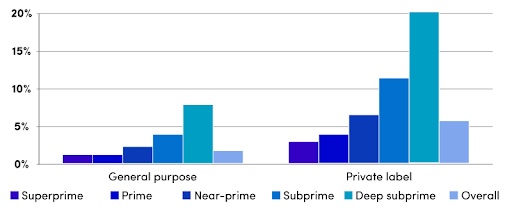

Generally, “superprime” shoppers, who hold 59% of card accounts, paid just 21% of the late charges by volume in 2018, while “profound subprime” customers, who hold about 6% of card accounts, paid 24% of the late expenses created, as indicated by the CFPB’s 2019 Consumer Credit Card Market report.

Higher expenses by and large capacity as installment for worthwhile prize projects. As indicated by the CFPB report, late expenses are more normal on private name cards, for example, store and gas cards, than on broad cards. This is valid both by and large, and across all credit categories.[4] However, all-out charges on private mark card accounts added up to 5.8% of balances generally toward the finish of 2018, while expenses on universally useful cards were 2.2%.

Yearly expenses

Just 26 of the 100 cards reviewed by CreditCards.com in October 2020 charged a yearly expense, and the most widely recognized charge was $95. Seven of those 26 don’t begin charging a yearly expense until after the cardholder’s first year, while one might defer the yearly charge past the first year.

Loan expenses

As indicated by the charge overview, loan expenses are ordinarily 5% of the sum being removed. Of the 100 cards inspected, four cards permitted cardholders to keep away from loan charges, and two of them just do as such in select conditions. Another three cards don’t permit loans at all.

Obligation suspension expenses

Known as installment insurance, obligation assurance, or obligation dropping plans, these expenses are turning out to be less common in the card market, and less oppressive to cardholders. Before the 2009 CARD Act, almost one out of five records brought about the charge, tumbling to simply more than 6% of records by 2015.

In 2016 the rate of the expenses kept on declining from 5.8% of broadly useful expenses charged to 3.3%.[5] According to a 2011 Government Accountability Office report, charges for obligation security programs went from 85 pennies to $1.35 each month for each $100 of balance.

Equilibrium move charges

The quantity of cards highlighting balance move offers has declined from 90 out of 100 out of 2019 to 85 out of 100 out of 2020, as indicated by CreditCards.com’s expense review. A large portion of those – 72 out of 85 – consistently charge an expense, while nine don’t charge an expense. Notwithstanding, cards that don’t charge an expense force the standard APR on the moving equilibrium, while those that charge a charge normally force a lower APR on the equilibrium for a limited time period. Four different cards let cardholders pick between staying away from the equilibrium move charge on the off chance that they acknowledge the standard APR on the equilibrium and paying the expense and tolerating a lower APR for a while. The most well-known equilibrium move charge is 3% of the balance.

Unfamiliar exchange charges

Unfamiliar exchange expenses have fallen since 2015 when 77 out of 100 cards charged them. In 2020, that number had dropped to 42 cards charging the expenses out of 100. Rivalry for successive voyaging cardholders drove card backers to drop the charges trying to bait them. That is uplifting news for buyers who are wanting to travel again after the pandemic. The most widely recognized unfamiliar exchange charge is 3%.

Returned installment expenses

On the off chance that you make an installment that is dismissed by your monetary establishment, most Visas will charge you for it. Of the 100 cards reviewed in CreditCards.com’s charge study, 80 imposed a returned installment expense. The most well-known expense was $39.

The effect of interest

For purchasers who convey an equilibrium, interest can be costly. The normal yearly rate (APR) on a charge card with an equilibrium was 16.30% in May 2021, as per the Federal Reserve’s G.19 shopper credit report.[7] That implies a $5,000 offset with that rate could cost you $7,396.65 in revenue installments on the off chance that you make just the least installments, which would take care of the advance in 126 months. The normal APR for all cards, including those that don’t convey an equilibrium, was 14.61% in May 2021.[8]

For new card offers followed by CreditCards.com’s week after week rate study, the normal APR on the 100 most well-known Visas (not simply accounts evaluated revenue) remained at 16.16% in July 2021. Visa APRs have been encountering a descending pattern since the pandemic started. In March 2020, the public normal was 17.08%.

Most cards have variable APRs that are fixed to the banks’ great rate. Furthermore, banks set their excellent rate in sync with changes in the Federal Reserve’s benchmark government subsidizes rates.

APR with Visa types

The sort of Visa you have can affect the rate. Business charge cards have lower rates. The normal APR on a business card in July 2021 was 14.22% contrasted with the 16.16% public normal. New understudy arranged card offers had a normal APR of 16.78%, while cards designed for shoppers with terrible credit had a normal APR of 25.05%.

Yearly Visa charges by guarantors

Charges collected differ dependent on the card backer. One explanation might be that various guarantors target various crowds, like voyagers, understudies, or purchasers with low financial assessments.

For instance, the Citi®/AAdvantage® Executive World Elite Mastercard®, which is intended for very much obeyed voyagers, charges a $450 yearly expense. A portion of Citi’s cheaper yearly expense cards incorporate the CitiBusiness®/AAdvantage® Platinum Select® Mastercard®, which has a yearly charge of $99, and the Expedia® Rewards Voyager Credit Card from Citi, which has a $95 yearly fee.

Then again, none of Discover’s Mastercards charge yearly fees.

Yearly Mastercard expenses by clients

Yearly Mastercard expenses additionally shift contingent upon the kind of cardholder. For instance, somebody’s financial assessment can affect the kinds of charges they pay. Yearly expenses will in general be higher for superprime cardholders – individuals with the most noteworthy FICO ratings. One explanation could be on the grounds that those cardholders will in general be offered cards with the most worthwhile prizes, which will, in general, have higher yearly expenses.

By and large, almost $100 in yearly expenses in 2018. In the examination, prime cardholders paid somewhat more than $60 by and large; close prime cardholders paid about $50; and subprime and profound subprime cardholders paid somewhat more than $40.

Nonetheless, the commonness of yearly charges was least among cards intended for superprime cardholders. In 2018, around 25% of cards held by subprime and profound subprime cardholders had a yearly expense. In the examination, about 20% of cards held by close prime clients had yearly expenses; generally, 18% of cards held by prime clients had yearly charges and about 15% of cards held by superprime clients had yearly fees.

Understudies may likewise be offered various terms

As indicated by Student Monitor’s Spring 2020 monetary administrations report, 33% of four-year, full-time U.S. students have a Visa, Mastercard, American Express, or Discover card account in their own name.

While just 47% said they know their APR, the normal APR among those understudies is 3.4%, a number that could mirror the contribution of 0% limited-time rates, proposes Eric Weil, overseeing accomplice of Student Monitor. Of the 38% of students who have Mastercards, 5% say they have been accused of a late charge once.