In another paper, we answer this inquiry by concentrating on the United Kingdom’s Help-to-Buy (HTB) program more than 2014–16. The program worked with home buys with just a 5% upfront installment and brought about a sharp unwinding of the initial installment imperative. We show that HTB supported family utilization as well as animating real estate market activity. Home buys expanded by 11%, and the increment was driven primarily by first-time and youthful purchasers. Furthermore, family utilization developed by 5% more in pieces of the United Kingdom that were more presented to the program. Loosening up the upfront installment requirement in this way has significant macroeconomic impacts that reach out past the real estate market.

Why up front installment requirements matter

Since contracts ordinarily cover under 100% of the price tag, hopeful home purchasers need adequate reserve funds to back an upfront installment. While getting a home loan, the upfront installment requirement is one of a few diverse acquiring limitations that become an integral factor. Because of exemplary influence impacts, this imperative has significant and nonlinear ramifications for lodging reasonableness. Moving the credit to-esteem prerequisite (LTV) from 90% to 95% pairs the sum a purchaser can get for a given upfront installment. For instance, a family with £10,000 put something aside for an upfront installment would have the option to purchase a house worth just £100,000 with a 90% LTV, however one worth £200,000 with a 95% LTV. In addition, for families that experience issues putting something aside for an initial installment, this imperative will in general be the most habitually restricting.

Help-to-Buy

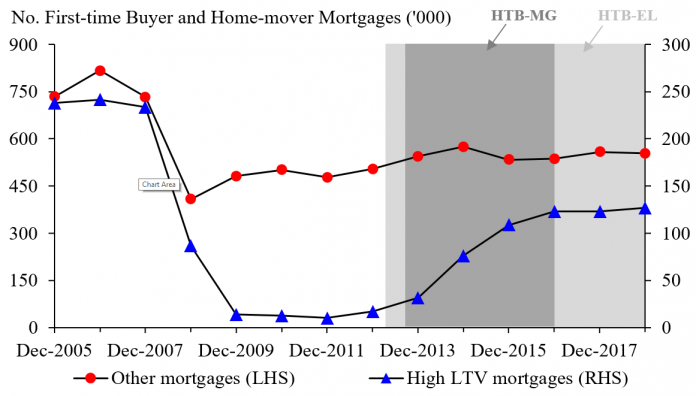

After the monetary emergency, high LTV contracts turned out to be scant and most home loans in the United Kingdom required an initial installment of 10% or more (Figure 1). Against this background, the UK government acquainted the Help-with Buy (HTB) program in 2013. A vital target of HTB was to make home purchasing more open for families that couldn’t bear the cost of the initial installment needed at the hour of its presentation. The Mortgage Guarantee (MG) and Equity Loan (EL) Schemes permitted families, under specific conditions, to buy a home with just a 5% upfront installment. The program accordingly addressed a huge and unexpected unwinding of the initial installment requirement in the UK contract market.

Figure 1: Number of home loans, by upfront installment class

Picture

A line diagram showing Figure 1: Number of home loans, by initial installment class

Evaluating the effect of Help-to-Buy

Given the above focuses, it is possible for this sort of mediation to altogether affect a few components of the real estate market. Be that as it may, it isn’t direct to measure the impact as numerous different components can affect the interest for lodging too. To do this, a counterfactual is required: a gauge of what might have occurred without the program.

To make this counterfactual, we exploit the way that various pieces of the United Kingdom were contrastingly presented to HTB. Families with the restricted capacity to put something aside for an initial installment are not arbitrarily spread across the United Kingdom however will in general be amassed in explicit regions. These are regions where nearby lodging supply is more qualified as far as moderateness, lodging type, and certain neighborhood conveniences, like bars and cafés, schools, or stops, which are especially interesting to these purchasers who are somewhat youthful. These neighborhood real estate market qualities will in general change just leisurely over the long run. Thus, regions, where families might want to buy a home with a 5% initial installment, remain moderately stable over the long run.

To take advantage of this geographic variation in openness to HTB, we build an HTB openness measure utilizing point-by-point information on completely controlled home loans started in the United Kingdom from the Financial Conduct Authority. We characterize openness to HTB as the extent of families inside a nearby power locale that purchased their home with a 5% upfront installment in the period before the monetary emergency (2005–07). As is obvious from Figure 2, openness shifts essentially the nation over. In our investigation, we analyze real estate market movement and family utilization in low-comparative with high-openness regions previously, then after the fact HTB became effective while controlling for a wide scope of local macroeconomic and real estate economic situations. Low-openness regions can work as a benchmark group as purchasers around there are probably not going to respond to HTB.

Figure 2: Geographical variety in openness to Help-to-Buy

Picture

Guide of UK showing Figure 2: Geographical variety in openness to Help-to-Buy

Real estate market

Our outcomes show that more than 2014–16 (when the MG and EL plans were dynamic), home buys expanded by 4.5% more in pieces of the United Kingdom that were more presented to HTB. This expansion was primarily because of houses bought with an initial installment of just 5%. In total, we gauge that HTB brought about an extra 220,000 home buys in 2014–16, addressing a 11% increment in homes bought by first-time purchasers and home movers over the period. Of those, we gauge that 78% were bought by first-time purchasers and 90% by more youthful families. We likewise track down that external London, areas that were more presented to the program encountered an unobtrusive 1.1 rate point higher house value development. In the London region, the effect was bigger (4.6 rate focuses), reliable with past research that discovers the versatility of lodging supply — which is more fragile in not really settled whether house costs responded to the HTB plot.

Family utilization

To evaluate the more extensive ramifications of HTB, we use utilization information from the Living Cost and Food Survey and information on all new vehicle enlistments. We again contrast areas more and less uncovered with HTB and look at how utilization responded after HTB was presented.

We track down that complete family utilization expanded by 5% more in pieces of the United Kingdom that were more presented to the program. This was part of the way determined by an increment in home-related use, yet additionally because of an ascent in nondurable utilization random to the home. More youthful families were totally answerable for the development in utilization. Furthermore, new (advance financed) vehicle acquisitions were 4% higher in more uncovered districts during the HTB time frame. These outcomes are autonomous of changes in provincial house costs.

To close

Loosening up the initial installment limitation accordingly decidedly influences family utilization as well as invigorating real estate market movement. Critically, the effect on utilization goes past the recently archived home buy and lodging abundance channels. While it is trying to measure the different components at work, two elements are probable at play. In the first place, the way that youthful families drive the development in utilization is reliable with the possibility that putting something aside for an upfront installment can go about as a limiting liquidity imperative. By releasing initial installment requirements, HTB might support utilization on the grounds that hopeful home buyers at this point don’t have to save a lot to gather an adequate initial installment and subsequently can spend more. Second, an ascent in local monetary movement because of HTB probably added to the positive utilization impacts too.